Case Study: Sharia Online Time Deposit on the Hijra App

- Pratiwi Nur Amini

- May 4

- 7 min read

Updated: Jun 4

🤔 a little back story and the problem

Hijra, formerly ALAMI Group, is a fintech company offering a range of services, including a P2P lending platform, mobile banking apps, and a business accelerator.

Despite currently providing a Time Deposit product, our growth is hindered by the manual sales approach used by Relationship Managers (RMs). To align with the transaction targets set in our 2023 Company OKR, we recognize the imperative for a scalable system.

Therefore, we aim to develop a Time Deposit feature in the HIJRA app. This initiative aims to enable customers to easily open Time Deposit products directly from their smartphones, eliminating barriers related to distance and time.

My Role | Product designer (conception, visualization, interaction, UX and UI Design, Testing, Prototyping, coordinating with developers and PMs, pitching to stakeholder) |

Team mates | Ahmad Zikri (Direct Lead), Sukmayanti (PM), Sefrina Zafira R. (Product Researcher), Safira Ardya (Product/UX Writer), Fahmi Murpratomo (Mobile Engineer), Vicky Hermawan (Engineer), Nurhadi Wibowo (Mobile Engineer), Hadyan P. Y (Backend Engineer) and other engineers |

Key Expert/Stakeholder | Hijra Ops Team, Hijra Users |

Dates | August 2023 - January 2024 |

Sector | Digital Bank |

🎨 Design Process

Given the limited timeline of 3–4 months set for this project, we adopted a Lean UX approach to ensure we could move quickly while still maintaining a user-centered design process. By focusing on rapid cycles of defining, designing, and validating, we were able to stay aligned with the project's goals and make informed decisions efficiently.

Defining: Who is this for?

At this stage, our primary goal was to identify and understand the target users for the upcoming online Time Deposit feature. Drawing from HIJRA Bank’s existing personas that our product researcher categorizes, we determined that this product would be particularly relevant for two key segments:

The Modern Muslim Guru

First-time Investors seeking low-risk financial products

The Modern Muslim Guru is typically someone who is financially stable and aspires to achieve holistic success—both in this world and the hereafter. This drive often emerges following significant life milestones or challenges, such as the passing of a loved one or the transition into parenthood, prompting deeper reflection on the importance of long-term financial planning and spiritual alignment.

Persona Snapshot: Modern Muslim Guru

Occupation: Entrepreneur or white-collar professional in a multinational company

Age Range: 28–35 years old

Marital Status: Married, typically with children

Socioeconomic Status: Middle to upper class

Goals: Seeking secure, sharia-compliant investments aligned with Islamic values

Motivations: Financial growth, spiritual fulfillment, and legacy-building

This persona is not only financially literate but also deeply intentional, making them an ideal user for a stable, low-risk product like a time deposit. Our design decisions throughout the project were informed by this understanding.

Defining: Benchmark analysis

To inform our approach to designing the Online Time Deposit feature, I conducted a benchmarking study of several widely-used digital banking apps, including Jago, Aladin, and Blu. At the time, sharia-compliant deposit products were still relatively limited in the market, so these apps were used as comparative references to help us understand prevailing design patterns and user flows in the deposit journey.

I explored the entire user journey across these apps, focusing on both the onboarding and post-deposit experiences. Interestingly, despite branding and design differences, many apps followed a similar core structure when presenting their time deposit offerings. These common elements included:

Clear Unique Selling Propositions (USPs) and product overviews

Introductory explanations of Time Deposits and contract types

FAQs to address common user questions

Return simulations and earnings projections

ARO and Non-ARO options

Terms and Conditions disclosures

Multi-channel notifications (push, inbox, email)

A list view for active deposits

Withdrawal processes for maturing deposits

These insights helped us define a strong baseline for user expectations, which we later refined to align with Hijra Bank’s values and product principles.

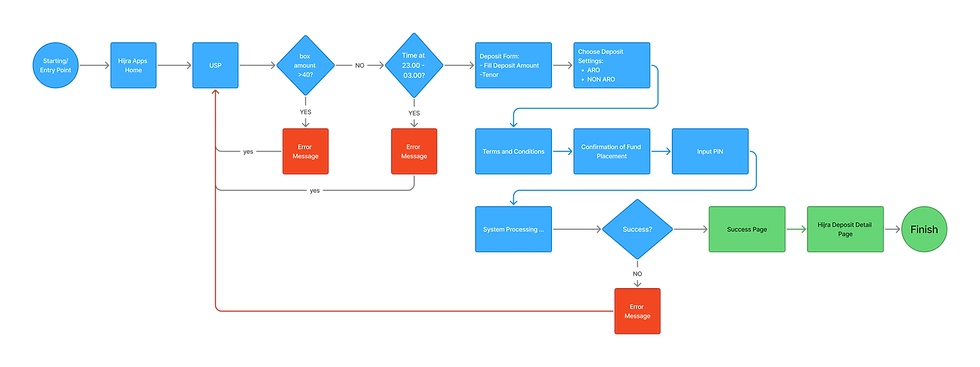

Designing: User Flow

Before jumping into high-fidelity user interface design, I first focused on defining the user flow. It was essential to map out what users would see first, how they would interact with the product during their initial experience, and what the journey would look like when entering a deposit amount. I also considered various system states, such as success, failure, and pending, as well as the flow for withdrawing funds, both before and at maturity. Identifying these core steps and edge cases early on helped ensure the design was complete and functional before moving into prototyping and user testing.

User Flow Create Deposit:

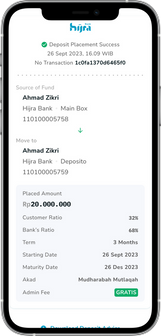

The Create Deposit flow shares many similarities with the digital banking apps we benchmarked earlier. It includes familiar steps such as the entry point to access the Online Time Deposit feature, a clear Unique Selling Proposition (USP), input for amount and tenor, and a final success page upon completion.

However, there are several important considerations that make our implementation unique. In the Hijra app, each deposit is treated as a “box”, and there are limitations to how many boxes a user can have. This means we need to perform checks during the creation stage to prevent users from exceeding their box limit.

Additionally, we account for time-sensitive constraints, our core banking system undergoes scheduled maintenance during specific hours, so it's important to validate the time of transaction before allowing deposit creation.

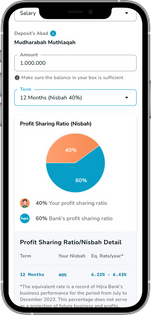

As for the deposit settings, we chose to release the ARO (Automatic Roll Over) feature first as part of our MVP. This is a focused decision, differing from other apps that may offer a broader range of deposit configurations from the start.

Aside from these custom rules, the rest of the flow remains relatively straightforward. If no issues arise during the process, users are seamlessly redirected to the Deposit Details page once their time deposit has been successfully created.

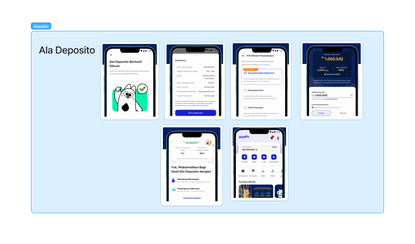

Sketching and Designing UI: I began the design process with quick paper sketches to map out the flow and structure of the Online Time Deposit feature. This helped me explore ideas rapidly and clarify the user journey before moving into digital wireframes.

I translated the sketches into high-fidelity mockups. Here’s how it turned out!

Validate: Testing with Users To inform our product decisions, the research team recruited several Hijra users who had experience with both conventional and sharia time deposits. We began with a qualitative survey to identify users who had previously invested in deposits, then followed up with in-depth interviews to gather deeper insights. These interviews explored users’ experiences and preferences related to the deposit flow, interface design, typography, and copywriting, helping us align the product with their expectations and build a more user-centered experience.

Key insights:

What worked: Users responded positively to the competitive nisbah (profit-sharing rate), low minimum deposit amount, and overall simplicity of the deposit process.

What we learned: Some copy and terminology needed refinement. Terms like “ARO” (Automatic Roll Over) were unfamiliar to new users, and phrases like “Advis” created confusion due to a lack of contextual explanation. Additionally, some content in the onboarding and terms & conditions screens felt inconsistent, leading to misinterpretation.

Opportunities: Streamline form steps, align all labels and messages with user mental models, and improve copy clarity to build confidence, especially around key terms, actions, and system feedback.

These learnings helped us iterate on the content and messaging, ensuring the final experience felt both trustworthy and easy to navigate.

✨ Final Design

After several rounds of iteration, here is the final design.

🚀 Results and takeaways:

Since launching the Online Time Deposit feature in February – March 2024, we’ve seen strong traction and promising early results, both in terms of user adoption and platform performance. The goal of this release was not only to introduce a sharia-compliant investment option but also to ensure that users could experience a seamless, trustworthy, and efficient deposit journey from start to finish. By focusing on user needs, technical reliability, and clear communication, we were able to make meaningful progress in a relatively short amount of time.

Here’s a snapshot of the impact so far:

Customer acquisition reached XX new users in the first half of the year a 71.60% growth from our initial XX users.

Deposit volume climbed to Rp XX billion, reflecting nearly 5x growth from the initial Rp XX billion.

Retention rate now stands at 70.59%, showing strong user loyalty and satisfaction.

And the success rate for opening deposits in real time has hit 87.4%, meaning most users complete the process without a hitch.

Not bad for a few months of hard work. Hooray! 😏🎉

*Some of the numbers are partially hidden due to confidentiality reasons.

💬 Reflections:

This project was particularly meaningful for me, not only because it was the first time I led a complete design process for a major feature in the Hijra app, but also because it marked a shift from my usual domain. Previously, my focus had been primarily on the P2P lending platform, where I worked on optimizing flows and ensuring compliance for productive financing. Designing for Hijra’s retail banking app, especially a product like Online Time DeposiT, was a completely new challenge.

I had no prior experience building investment-related features, especially within the context of sharia-compliant banking. With limited time and resources, I had to quickly immerse myself in the product, its contractual and religious nuances, and its business significance. It demanded fast learning, cross-functional collaboration, and a shift in mindset from operational optimization to user acquisition and trust-building.

While the core goal of this project was to drive new user acquisition, I quickly realized that designing a financial product, especially one involving people’s savings and religious values, still required empathy and clarity. For many users, time deposits can feel abstract or even intimidating. My role was to design an experience that felt secure, understandable, and aligned with their values, particularly for first-time investors.

One of the biggest lessons I took from this project was the importance of working lean. In a startup, time and energy are limited, so it becomes crucial to prioritize features that deliver immediate, tangible value. Building a strong Minimum Viable Product (MVP) taught me how to focus on what matters most, test assumptions early, and align cross-team efforts toward shared goals.

Most importantly, this project reminded me that even when the business goal is growth, good design is about removing barriers, simplifying the complex, and building trust. That, too, is solving real problems, just from a different lens.

Oh, and don’t forget to download the Hijra app to try out the Online Time Deposit yourself! 😉

Comments